🏛 Established in 1997

Finance & Mortgage Solutions

Tailored lending advice to unlock your financial freedom.

Access to more than 40 Australian-based lenders

We're a multi-award winning finance broker

Latest LinkedIn Updates

Stay updated with the latest insights and tips from our finance expert.

Finance Should Feel Simple!

Streamline operations with cutting-edge solutions that future-proof your business for lasting success and guarantee remarkable growth.

Boost Your Borrowing Power

We structure applications that win lender approval the first time.

Transparent Process

Fast Approval Times

Extensive Lender Network

Access to 40+ Australian lenders including major banks, credit unions, and specialist lenders all from one centralised platform.

Your Loan, Streamlined

Send your documents once. We benchmark offers from 40+ Australian lenders and negotiate the sharpest deal while you follow every milestone through clear, jargon-free updates.

One Upload

Securely supply your paperwork a single time—no endless form-filling.

Live Status

Track progress in real time from pre-approval to settlement.

We Are Here to Help, Every Day

Our brokers guide you from first chat to settlement, offering holistic, objective advice and keeping your needs front and centre through every change in circumstance.

Everyday Support – Reach us any time for updates or questions

Holistic Advice – We review your full financial picture before recommending a path

Tailored Solutions – Loan options matched precisely to your goals and budget

Clear Communication – Simple, upfront updates so you always know what's next

Tailored Finance for Growth

Whether you want to grow your business, purchase your forever home, or build a property portfolio, we’re here to make it happen.

Real-World Expertise

Real-World Expertise

Transparent Process

Transparent Process

Outcome Focused

Outcome Focused

40+ Lender Network

40+ Lender Network

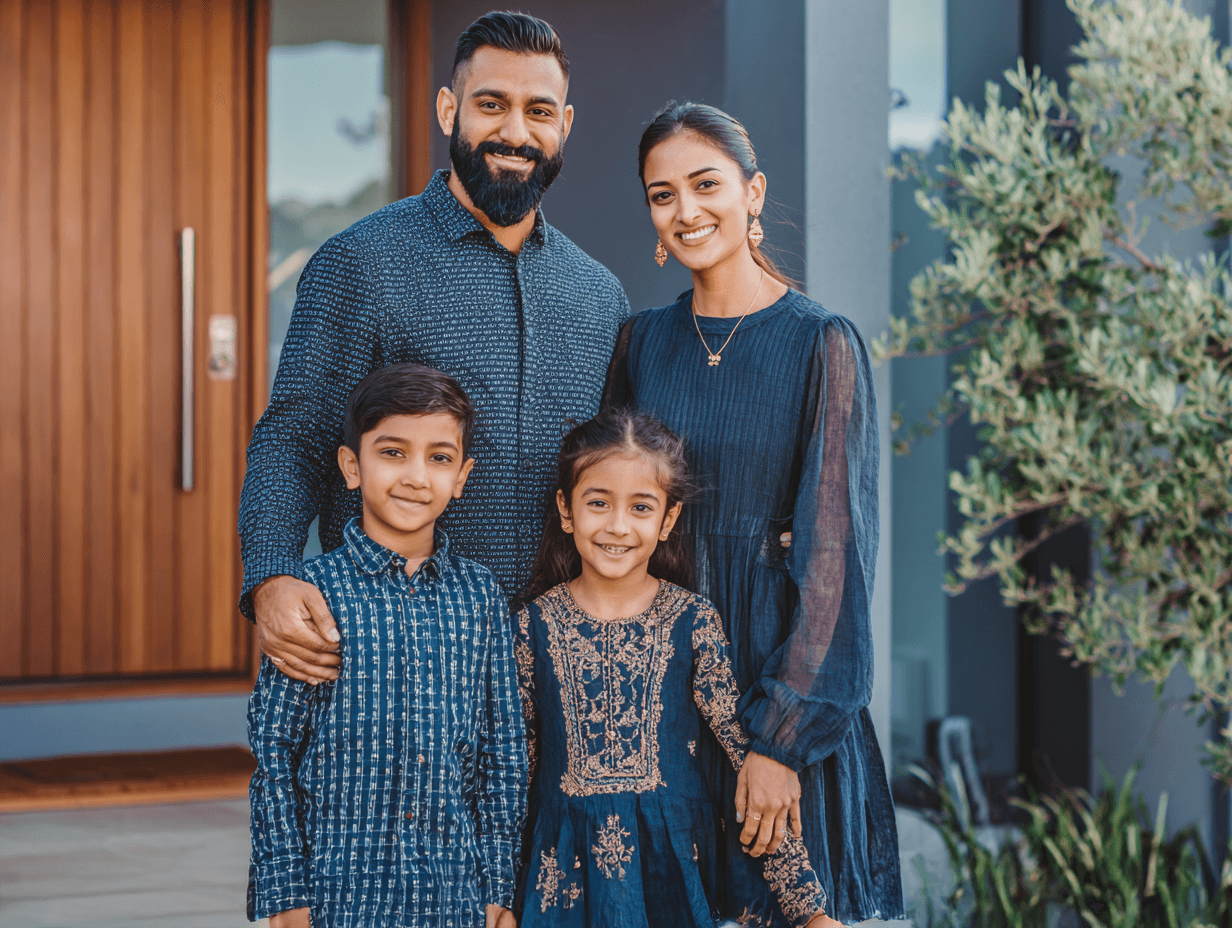

Trusted by Australian Borrowers

Real stories from first-home buyers, investors, and brokers we’ve helped succeed.

“I would like to thank Madhu Chaudhuri for guiding me on right path to become a successful mortgage broker. You have been a fantastic mentor and I highly recommend you to any broker seeking guidance.”

“Madhu gave me confidence when I was buying my first home. Within a year she helped me secure my first investment property without touching my savings.”

“The team made refinancing my investment property seamless. Their advice was always clear and I felt supported at every step.”

Our Latest Articles

Dive into our blog for industry insights, tips, and news. Stay informed and inspired with our latest articles and updates.

Frequently Asked Loan Questions

We answer these every day—so here are the basics at a glance.

01What documents do I need to begin?

02How long does approval usually take?

03Do you charge a brokerage fee?

04Can you help if I’m self-employed or on a temporary visa?

05How often should I review my mortgage?

06Which lenders do you work with?

Start Your Finance Journey Today

Book a free 15-minute call and discover your smartest loan strategy.